I know what you are probably thinking, “Risk Management? What is that? And why do they say they specialize in it? Aren’t they just your run of the mill insurance agents?” Well, you may be right, but Risk Manager has a nice ring to it don’t you think!

No, in all reality, there is a big difference in how we do commercial insurance at Mid America Specialty Markets. We approach commercial insurance from a Risk Management platform. We do not just sell you insurance. Unfortunately many insurance sales people are just looking for a quick sale. Too often they will sell you an insurance policy and then you never hear from them again.

As risk managers, the first thing we do is to determine if your company is a good fit for one of our commercial insurance companies. Next, we’ll help you determine the proper insurance coverage that would best fit with you and your company’s insurance needs and specific asset protection situation. As an example, you wouldn’t believe how many business operations out there work under the wrong or inaccurate workers compensation code. Often times those mistakes lead to you, the business owner, paying a higher workers compensation premium than necessary. And that’s why we have one the most knowledgeable workers compensation professionals’ right here in our agency.

You’ll find when we work with you on your commercial insurance needs that we’ll discuss the best ways to protect you and your business, no matter what your business is. Even Randy Sieberg CIC, ARM, CRM, our Certified Risk Manager (CRM), will tell you that managing risk is the whole basis for understanding how insurance works. So in this post I’m going to spend a little time and go over exactly what risk management is so you’ll then have a better idea of how we handle commercial insurance and what we do here at Mid America Specialty Markets.

What is Risk Management?

“Risk management is the process of identifying, analyzing, evaluating and treating loss exposures with the goal of reducing the financial or adverse effects of loss.” That’s one of the most common definitions of risk management.

What are Loss Exposure, Elements of Loss and Types of Perils?

Everything in insurance starts with the idea that you have something to protect. Something that if it caught fire tomorrow or was somehow lost or destroyed would be a major problem in your life causing a significant financial loss and or hardship. Everything that needs to be protected, property or persons, must be protected from something that may cause loss. That something is known as a “loss exposure.”

There are three elements of a loss exposure. They are: 1) a valuable or asset exposed to loss; 2) a peril or cause of a loss; and 3) a financial consequence of the loss. A loss exposure is any situation or condition that can lead to a potential loss. When that potential loss occurs, it happens because something happens or goes wrong. That something that goes wrong is known as a “peril.”

Three types of perils are human, economic and natural. It can also be known as a cause of loss. You may be familiar with this concept. Peril is usually described as something that causes or that may cause a loss. Simply look on the front page of your property insurance policy, or the declarations page, and pay attention to your deductibles. One type of deductible is known as the multi-peril deductible and the other one is the wind/hail peril deductible. One is just for wind/hail perils and then the other is basically for all other perils as identified and covered on the policy. Both deductibles apply as described in the policy but only for a covered cause of loss.

What is Risk?

It’s because of perils and exposures that we manage risk because although things happen through accidents and acts of nature, it’s important to identify what can help lesson or mitigate the impact of a loss. An example would be where architectural shingles are more resistant to hail which is why with many insurance companies you’ll receive a discount if you have architectural shingles on your home. Exposures and perils are an important part of managing risk because they are how we identify the potential to loss. After all, you have to know what the risk is before you identify and develop the best way to treat the risk.

There are three parts of what happens when a loss occurs; pre-loss, during a loss and post-loss. I know, I know, you’re probably wondering why I stated that right? ‘Elizabeth, almost everybody knows that! That was not very helpful at all!’ I mention this to give you an idea of what the objectives are when a loss occurs. It’s how all insurance companies operate. Those of us that practice risk management take these moments to observe and learn from past mistakes and find out what can help in the future.

Regarding pre-loss, or before the loss even occurs, the question is how did it happen? What was the chain of events that led to this loss happening? During the loss, your insurance company will look at what happened and if what happened is a covered loss. In risk management you’ll find there are many types of how we address loss, but I will only discuss two of those ways in this post. Those two ways are pure loss and a speculative loss.

A pure loss is something bad that occurs that there was no chance of anything good coming out of it like if you fall in an icy parking lot. Nothing good is bound to come out of that, and you consider yourself lucky if you are still in the same shape before you fell.

A speculative loss is something that bad or good could occur. For example in gambling, although you’re probably going to lose a lot more then you win there’s still a chance you could win.

Every loss that insurance deals with is a pure loss; nothing good could possibly come out of what happened. Claims adjusters will try and determine if your insurance coverage would apply and if the loss is a covered loss. They also look at the safety, compliance, lawful and ethical behavior when the loss occurred.

Post-loss does not affect you as an insured or policy holder too much except that the company looks at everything that occurred and will try to figure out better ways to ensure that if or when that type of loss occurs again, they will be better prepared and will be able to reduce similar future losses and improve disaster recovery.

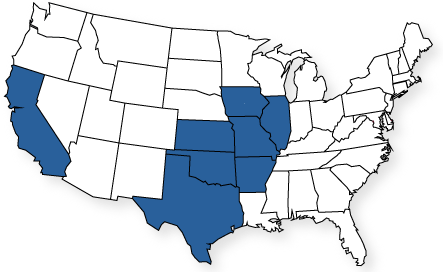

For certain identified loss exposures you’ll find that some insurance companies will determine it’s better for them not provide insurance coverage. For example some insurers might feel that it is better not to insure semi-trucks or over the road hauling. Probably because they do not have the experience to properly identify all the loss exposures present or possibly they do not have the ability to handle claims that may occur in different parts of the country. In this case the insurance company would stop all those future losses for that type of exposure. Even though an insurance company’s main job is to protect you when a loss occurs, they also look to protect themselves from too much exposure to loss and to ensure the company’s survival.

So that’s typically what’s looked at by an insurance company when a loss occurs. It is all a part of managing risk for not only you but the insurance company as well.

Although you might have something to protect, everyone accepts the risk that something could happen that causes loss, financial loss or some kind of loss to the object. For example with your car, your chances of getting in an auto accident are greater when you drive in city traffic rush hour but you still drive to work. So, we’re all risk managers in one way or another because as risk managers or analysts we recognize a risk exposure and then we try to treat the risk. We accept that a risk exposure exists and then we try to create ways to try and control, prevent or reduce the losses that might happen. Administering risk and reducing risk exposure is something we all do every day. It’s through implementation of risk control that you attempt to reduce the chances of any future losses. And it’s by monitoring and adjusting those risk control procedures for effectiveness that completes the risk management circle!

This is what we do when you come to Mid America Specialty Markets asking us to provide you with a business insurance quote. We look at the different risk exposures your company faces. We help you identify those risk exposures. We work with you to come up with the best insurance coverage to address those risk exposures. We help you monitor the risk controls developed to address your risk exposures. And we blend together insurance products and awareness to help protect your company assets!

And that’s what we do when we say we help you manage risk!