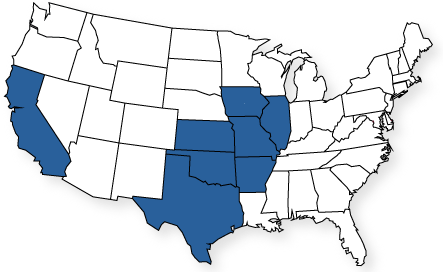

Looking for General Liability Insurance in Missouri?

Are you a business owner in Missouri or the surrounding area and looking for General Liability Insurance? Our agency has you covered. It only takes one claim to financially cripple your business, so it’s important that you have adequate coverage from a highly rated carrier.

General Liability Insurance (Commercial General Liability Coverage) is the most basic form of commercial liability coverage. We’ve seen it written that if you own a business, having General Liability coverage is not optional — it’s mandatory! Ok, it may not actually be mandatory in the sense that it’s required by some state or federal regulation, but operating any business without having general liability insurance in place will expose your business to possible financial ruin due to uninsured claims against your business.

At Mid-America Specialty Markets, we represent a wide range of General Liability Insurance companies in Missouri and can help match up your business type with the best possible coverage at the most competitive cost.

What does General Liability Insurance Cover?

Business operations are exposed to a great deal of risk on a daily basis. Simply opening your door for business every morning creates a possibility of liability loss. General Liability Insurance products protect you and your business against both identified and unidentified loss exposure.

Simply put, Commercial General Liability Insurance provides protections for you, your business and your employees from claims involving bodily injury or property damage arising out of your business operations. The general liability policy covers the expense of out-of-court settlements, litigation and judgments awarded by courts. General Liability Insurance can be offered as a stand alone policy or it may be included in some type of Commercial Insurance Package that will bundle the general liability coverage with, commercial property, tools and equipment and other coverage items to create a Business Insurance Package. Smaller package insurance programs are often referred to as a BOP or Business Owners Policy. What ever the structure of your business insurance program the general liability insurance coverage is a cornerstone of protection.

Here’s a few loss exposure topics that you can expect your General Liability Insurance policy to cover:

- Lawsuits Alleging Bodily Injury or Property Damage

- Claim Investigations

- Claim Settlements

- Bodily Injury Damages

- Advertising Claims

Who Needs General Liability Insurance Coverage?

We briefly touched on the need to carry this valuable insurance coverage above. But let’s take a minute to look a little deeper!

General Liability Insurance coverage provides a financial backing for your business in case you become involved in some claim against you, your business and your employees for bodily injury or property damage. If you take the time to read a policy you’ll find the general liability insuring agreement starts with this phrase:

“We will pay those sums that the insured becomes legally obligated to pay as damages because of “bodily injury” or “property damage” to which this insurance applies.” Of course there are many limitations found within a policy contract. Yes, an insurance policy is actually a contract between the Insured (you) and the insurance company.

Who needs this coverage? The quick answer is anybody who operates a business, provides a service and or provides a product for consumption or use. This coverage is the cornerstone of any insurance program design. Here’s a few businesses that could not survive with General Liability protection.

- Auto Repair Shops and Body Shops

- Contractors and Others in the Construction Industry

- Manufacturers

- Distributors

- Retail Operations

- Drug Stores

- Department Stores

- Professional Offices

- Floor Covering Installers

- Cabinet Makers

- Electricians

- Plumbers

- Concrete and Excavation Operations

- Restaurants

- Commercial Buildings

- Hospitals

- Medical Offices

- Dentist Offices

- Should we go on?

Needless to say, if you own a business, any kind of business, you need a general liability insurance policy!

When Does General Liability Insurance Apply?

As we mentioned above, the insuring agreement of the policy begins with: “We will pay those sums that the insured becomes legally obligated to pay as damages because of “bodily injury” or “property damage” to which this insurance applies.” It’s here that we need to focus on “legally obligated to pay.” For a general liability policy to respond the insured must be “legally obligated to pay” which means the insured (you and your business) must be held negligent for the actions that caused the bodily injury or property damage. Of course there are other coverage items contained within the standard general liability policy.

What’s Not Covered in a Standard General Liability Insurance?

These policies are complicated. They are contracts and they contain various insuring agreements, exclusions and policy conditions that dictate how coverage will and will not apply. Here are a few items that you may be surprised to know are not covered under the Standard General Liability policy:

- Your Work – A general liability policy is not a guarantee of workmanship. In it’s basic form, the policy provides coverage for bodily injury and property damage. The “Your Work Exclusion” is one of policy exclusions commonly referred to a business exclusion. Want know the other business exclusions? Give us a call!

- Your Product – Another exclusion found within a general liability policy is the exclusion for your product. Damage your product causes may be covered under the policy but your specific part or product is not covered.

- Intentional Acts – General Liability Insurance does not cover damages or injuries caused by expected or intentional acts on the insureds part.

- There are many more coverage exclusions that apply to a general liability policy and how its coverage responds.

Other items excluded in these policies are done so because another policy would provide better coverage. Items covered better by other policies include:

- Employee Injuries – When your employees are injured at work the Workers Compensation Policy is the policy that responds.

- Professional Liability Exposures – General Liability Insurance does not cover a professional error or mistake and is excluded from the policy. You would need to secure a professional liability policy that provides coverage for your consulting work, professional services and opinions.

- Automobile Liability – Your general liability policy excludes automobile liability. You would need to secure a business auto policy for this exposure to loss.

Of course there are many more coverage exclusions found within the general liability policy!

What’s involved with getting CGL Insurance?

With any type of insurance there are certain underwriting and eligibility questions that must be answered in order for the insurance company to determine what the final rating will be.

Our agency will guide you through the process and make it easy. Many times companies will require you to show them a certificate of insurance before you can do work for them.

This proves to them that you have active insurance coverage, which is typically a requirement if you’re running a business in most states.

If you’re confused by any of this don’t worry, we’ll make the process easy. Give us a call and we can help you get the process started when you’re ready.

How to get started on your quote

To get started on your quote, call our office or click over to our quotes page. Either way we’ll make the process simple!