Looking for Farm or Crop insurance in Missouri?

We’ve got you covered.

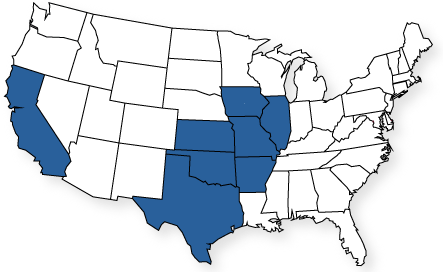

At Mid-America Specialty Markets we realize that farming is the backbone of our country, and no matter how large or small your farming operation is, we have the expertise to help properly insure your business.

Being independent, we have access to a wide range of farm and crop insurance companies. This is important because no two farming operations are the same.

We have the flexibility to truly find you the best possible product at the best price.

How to know when you need a new Farm Insurance Agent/Company

- Do you have crop insurance?

- Does your agent re-quote your policy every year?

- Does your agent visit your farming operation?

- Does your agent explain your coverage?

- Does your agent provide you with educational materials?

- Did your agent tell you about yield exclusions, revenue protection and seed endorsements?

- Does your agent offer crop hail policies?

- Do you know what sage coverage is available?

If you answered “No” to any of these questions, you need a new agent!

What does Farm Insurance cover?

- Vehicles & Trailers

- Buildings & Outbuildings

- Machinery/Equipment

- Livestock

- Rental Value

- Personal Property

- Crops

- Additional Living Expenses

- Liability

- Supplementary Coverages

- Sage Coverage

- Seed Endorsements

A Special Note About Farm Insurance From Elizabeth Heyen, Farm Specialist:

Farm insurance is a handy insurance product for farming operations because it is a highly customizable policy as you can chose to cover your buildings or certain farm equipment if you want. There’s typically no problem to add or remove your dairy barn or farrowing house. And if you live on a farm, it also protects your personal household property like your clothes, furniture and household appliances.

Farm property is broken down to farm machinery and equipment, livestock and farm products like seed, silage, animal feed, fertilizers and pesticides. These are some of the things that make a farm policy different from any other insurance policy, because it not only acts like a homeowners, it also acts like a commercial property policy.

A farm policy also provides coverage for your legal liability up to the limits shown on your policy. Medical payment coverage may also be included for people who are, with your permission, on your premises and become injured. It’s expandable coverages help the farm policy fit into your farming operations like cattle or hobby farms. It is particularly important to have livestock on your policy if you keep livestock as there is a liability exposure if your animals get out, wonder onto the road and get hit by a car.

Farm products, such as feed or grain growing on the property is not covered under the farm policy. You would need a crop insurance policy depending on what the crop is, such as corn, wheat, milo or soybeans. Though it may be covered on your farm policy while it is stored.

Of course you need to be careful as there are a few things that are not covered under your farm insurance policy. For example, fencing is not always automatically included in the farm policy. The reason for this is because some farmers fence their whole property and some do not fence any. There’s also the different types of fencing such as electric and barbed wire fencing, so the cost to replace one is different from the cost to replace the other. Though if the whole property is fenced it might be worth adding it onto your policy to provide coverage for example if a tornado came through. Especially since electric fences typically have a fail-safe that will trigger to shut the whole fence off if a portion is destroyed.

Just a few thoughts about our farm insurance programs. So remember, we’re available to help review your current farm insurance coverage and help identify and fill the gaps you may not know you have!

Thanks.

How much does Farm Insurance cost?

The cost of farm and/or crop insurance depends greatly on the type and amount of coverages you specifically need.

Because all farming operations are different, we’ll talk with you and visit your farm to do a comprehensive needs analysis to make sure that no stone is left unturned with your coverage.

If you need assistance with your farm or crop insurance, we’re the only number you need. A good farm insurance company does much more than give you a free hat or calendar!

How to get started on your Farm or Crop quote

To get started on your quote, call our office or click over to our quotes page. Either way we’ll make the process simple!