Insurance Options for your Accounting Firm Business

Insurance Options for your Accounting Firm Business

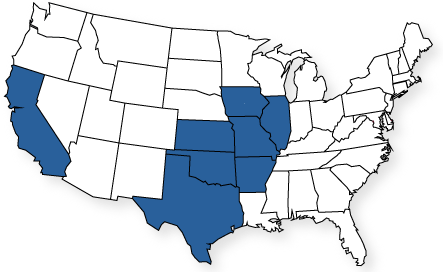

Mid America Specialty Markets provides insurance coverage to Accounting Firms

Accountants, CPA’s and other financial professionals deal on a daily basis with a great deal of private, sensitive financial information which leaves your firm exposed to loss from cyber and/or data compromise. This higher level of potential loss is created by personal financial data in your direct control. This high level of client data exposure makes your Accounting Firm Business especially susceptible to loss including theft of your client’s private data.

At Mid America Specialty Markets, we offer insurance coverage options for accounting firms that are designed to cater to the specific needs within your industry. We begin by having an understanding of the types of core insurance products that your business needs. Core business insurance products will include:

- Workers Compensation

- General Liability

- Property – Building and Business Personal Property

- Umbrella Coverage

- and Commercial Auto Coverage

Business Owner’s Policy

Most accounting firms are insured on what’s known as a Business Owners Policy. A Business Owners policy is a policy that combines the basic or core insurance products into one package.

A Business Owners Policy will typically include:

- General Liability Coverage – This coverage part protects your accounting firm business from legal liability claims that may be brought against your business that happen because of your operations. For example if a client of your’s is injured while visiting your office the general liability coverage would respond and provide you protection. If one of your firms accounts is working at a clients place of business and causes some type of property damage would be another example where the liability coverage would respond. General Liability Coverage will not protect you from damages caused directly by your accounting professional services.

- Property Coverage – This coverage part of the Business Owners Policy provides protection of your building and/or your business personal property. If you own your own building where your accounting firm office is located the BOP will provide coverage for the building from claims caused by fire, lightening, wind, and other property covered causes of loss. Building values will be determined by a replacement cost calculator while business personal property limits will be set by you. Business personal property is another term for your contents, your desks, phones, computers, telephones and other office furniture and fixtures.

- Loss of Income Coverage – Otherwise known as business income coverage. In the typical business owners policy you will find that business income coverage will provide you protection from loss of income if your office is damaged by a covered cause of loss and unable to conduct your normal accounting functions.

But that’s just the beginning.

Optional Insurance Coverage to Consider

To go along with the core coverage options we offer, we will work with you to create a protection plan that’s unique to your specific business. Most accounting firms we work with add these special items:

- Professional Liability Insurance Coverage – As a professional accounting firm employing accountants, CPA’s and other financial professionals in your business you will need to secure insurance coverage that provides your firm protection from damages caused by you and your employees while acting in their capacity as a professional. Don’t be confused and think that your core general liability policy will pick up your professional liability coverage because it will not! You must secure a professional liability policy.

- Cyber Liability and Data Breach Coverage – Your firm is in possession of personal, private financial information on each one of your clients. It is of the utmost importance to properly secure that data from exposure to loss. In today’s world, it’s almost impossible to completely protect that data. A Cyber Liability and Data Breach policy will provide you with protection when your firm has a data breach and your clients data is stolen.

- Employee Benefits and Employment Practices Liability Coverage – These two separate coverage parts provide specific protection to your business from employee related claims against your business.

As you can see, we are serious about providing your accounting firm with the proper insurance protection. Get in touch with one of our local offices and inquire about how we may be able to help provide you with enhanced insurance protection at potentially reduced insurance costs!

Insurance Options for your Accounting Firm Business

Insurance Options for your Accounting Firm Business